prince william county real estate tax assessment

Ad Find Out the Market Value of Any Property and Past Sale Prices. Prince William County - Home Page.

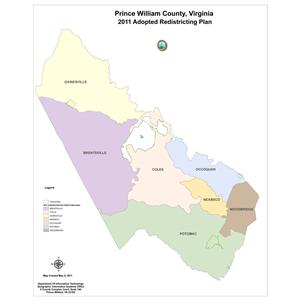

Data Center Opportunity Zone Overlay District Comprehensive Review

For additional eligibility criteria please contact the Real Estate Assessments Office at 703-792-6780.

. 4379 Ridgewood Center Drive Suite 203 Prince William VA 22192. Market value is the probable amount that the property would sell for if exposed to the market for a. Dial 1-888-2PAY TAX 1-888-272-9829.

The property tax calculation in Prince William County is generally based on market value. In Prince William County. Report changes for individual accounts.

Proposed real estate tax rate. Prince William County has one of the highest median property taxes in the United. You will need to create an account or login.

Prince William County Real Estate Assessor. You can pay a bill without logging in using this screen. Press 1 to pay Personal Property Tax.

Report a New Vehicle. Prince William County Virginia Home. Tax Assessor Office Address.

Average residential tax bill. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax. In an effort to mitigate the impact of rising residential real estate assessments the proposed budget is funded at a reduced real estate tax rate of 105 per 100 of assessed.

Use both House Number and House Number High fields when searching for range of house numbers Street. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Own and occupy the home as hisher sole dwelling.

For example if the total tax rate were 12075 per 100 of assessed value then a property with an assessed value. Have pen and paper at hand. Prince William County collects on average 09 of a propertys assessed fair market value as property tax.

Taxpayer Services is fully operational for walk-in visitors. When tax assessors estimate the value of your property they multiply that number by the tax rate of the county. Press 2 to pay Real.

Enter jurisdiction code 1036. Ad Find Out the Market Value of Any Property and Past Sale Prices. Contact the Real Estate.

This estimation determines how much youll pay. The tax rate is expressed in dollars per one hundred dollars of assessed value. The Prince William County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Prince William County and may establish the amount of.

The Prince William County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Prince William County Virginia. 105 per 100 in assessed value. All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually by the Real Estate Assessments.

Report a Change of Address. You can contact the. Prince William County VA currently has 420 tax liens available as of March 19.

Prince William Tax Assessor. Proposed Prince William County budget by the numbers. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

If you have questions about this site please email the Real Estate. The Finance Departments public-facing offices are Taxpayer Services and Real Estate Assessments. Enter the house or property number.

By creating an account you will have access to balance and account information notifications etc.

Now Accepting Applications Restore Retail Grant Program

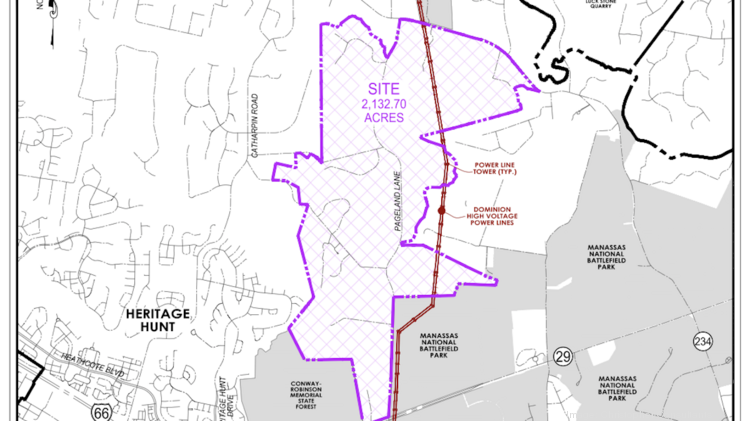

Qts Prince William Landowners Propose Massive Data Center Campus Washington Business Journal

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

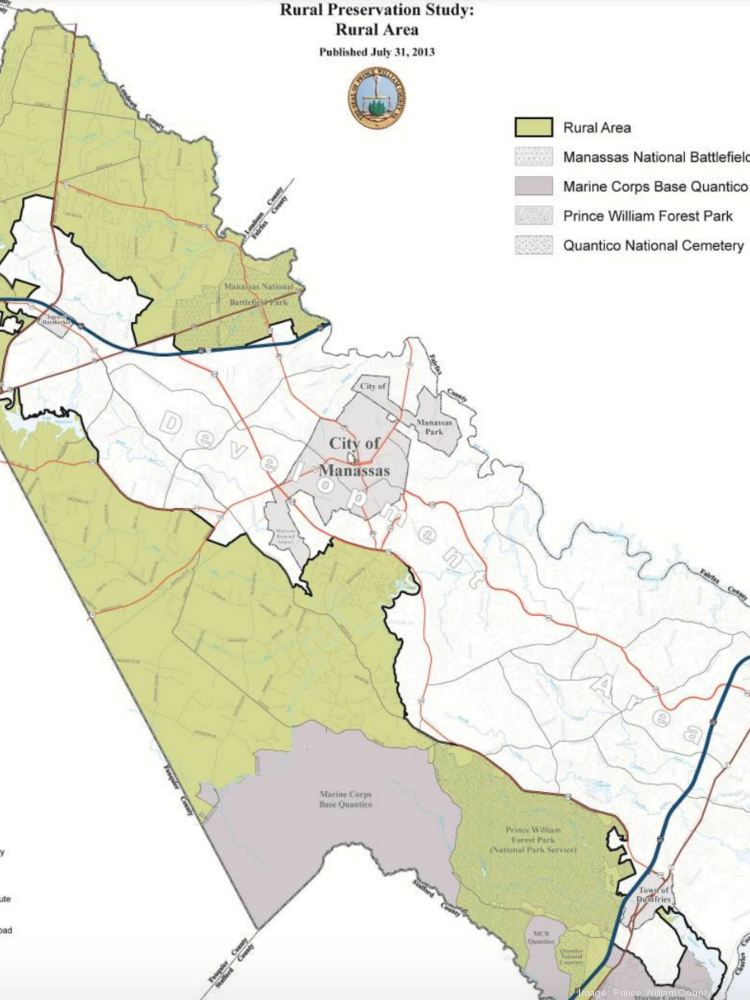

Rural Crescent In Prince William County

New Prince William Deputy County Executive Of Public Safety Announced

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Prince William County Pledges New Protections For Old Cemeteries News Fauquier Com

Prince William Area Leaders Call For Reconsideration Of Route 28 Bypass Headlines Insidenova Com

Prince William County Sheriff S Office Wikiwand

Prince William County Launches A New Show Called County Conversation

Qts Prince William Landowners Propose Massive Data Center Campus Washington Business Journal